About Money Advice

We are Money Advice

One of the UK’s leading IVA debt help companies specialising in consumer IVAs. We aim to provide practical and ethical debt guidance.

- We understand

We understand how stressful debt can be, so all our support is completely confidential, with no obligation. - Our Goal

Our specialist team is committed to helping people and businesses regain control of their finances by providing a simple, high-quality, friendly service at every opportunity. - Our Promise

Here at Money Advice we offer non-judgemental, compassionate and straight-talking support to help find the best solution for you, as we have done for 1000’s of customers across the UK. - What to do next?

No matter how large or small your debt problem is, we can help you find the best solution to suit your circumstances. It just takes one phone call, so what are you waiting for? Call one of our experts on 0161 640 6400, and we’ll gladly help.

Why choose us

What do we do?

Money Advice specialises in Individual Voluntary Arrangements (IVAs), which can help safeguard people in debt and protect their assets like a car or property.

Personal Finance is not a one-size-fits-all case, and we will work with you to find the best way to manage your debt. This means promoting sustainable financial well-being and ensuring we always offer relevant support for your circumstances and lifestyle.

If you qualify for an IVA, we can help you reduce payments, freeze interest & charges, stop creditor demands, and give you a precise end date, usually five years.

Our qualified, licensed Insolvency Practitioners (IPs) help you through your IVA, ensuring it runs smoothly.

Proud sponsor of Mental Health UK

In the UK, it is estimated that 50% of people in debt also experience a mental health problem. 1 in 5 people experiencing a mental health problem also experiences money issues. This is why Money Advice has chosen to sponsor Mental Health UK, a charity that help people better understand, manage and improve their financial and mental health by providing clear and practical advice and support.

Why are we different?

There is no obligation to sign up for anything after your initial telephone consultation.

We think the world of money can be complicated, as decisions about overcoming financial difficulty are significant, especially when there are many possible solutions. We understand this – that’s why we like to keep things simple.

So ask as many questions as you like, as often as you like. There’s no pressure from us to make a quick decision, and we’re here when you’re ready to move forward.

We have in-house insolvency professionals ready to set you on your path to a debt solution. This means that once we establish your eligibility, we can discuss the most appropriate solutions for you.

Read our success stories from real-life customers who had an experience worth shouting about. 9/10 of customers would recommend us to friends or family.

What our customers say

What to expect?

Tell us your situation

Taking these first steps can be daunting, but you’ll be treated with empathy and understanding. And you’ll be given the opportunity to speak freely about the difficulties you face. You’ll quickly see our commitment to helping you overcome them. We don’t judge, and we want to help.

Assess your situation

We’ll work with you to gain a complete picture of your circumstances, and this will help us provide genuine help accompanied by realistic options.

Explore your options

Our goal is to support you the best we can during this time. But ‘Best’ can mean different things to different people. Do you want to be debt-free as soon as possible? Or is a Good Credit Rating your priority? We’ll work hard to find the solution that fits.

Choose your debt solution

If you proceed with an IVA this will be under the Supervision of a regulated Insolvency Practitioner. We also provide you with a dedicated assessor who will manage your case throughout. So ask as many questions as you like as often as you like. There’s no pressure from us to make a quick decision, and we’re here when you’re ready to move forward.

Check if you qualify

Thousands across the UK have explored IVAs with Money Advice.

Take the next step towards a possible debt free future. We’re rated 5 stars by our customers on Trustpilot and have exceptional ratings on Feefo.

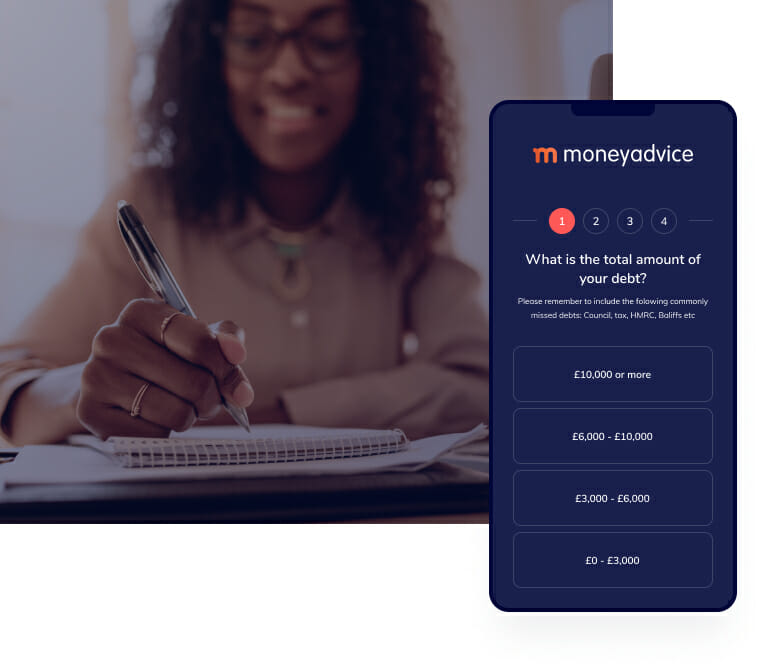

Could an IVA be right for you?

Answer a few questions to check your eligibility online.

Prefer to arrange a call?

Speak to us about debt solutions, including IVAs at a time that works best for you.

To find out more about managing your money and getting free advice, visit Money Helper, an independent service set up to help people manage their money.